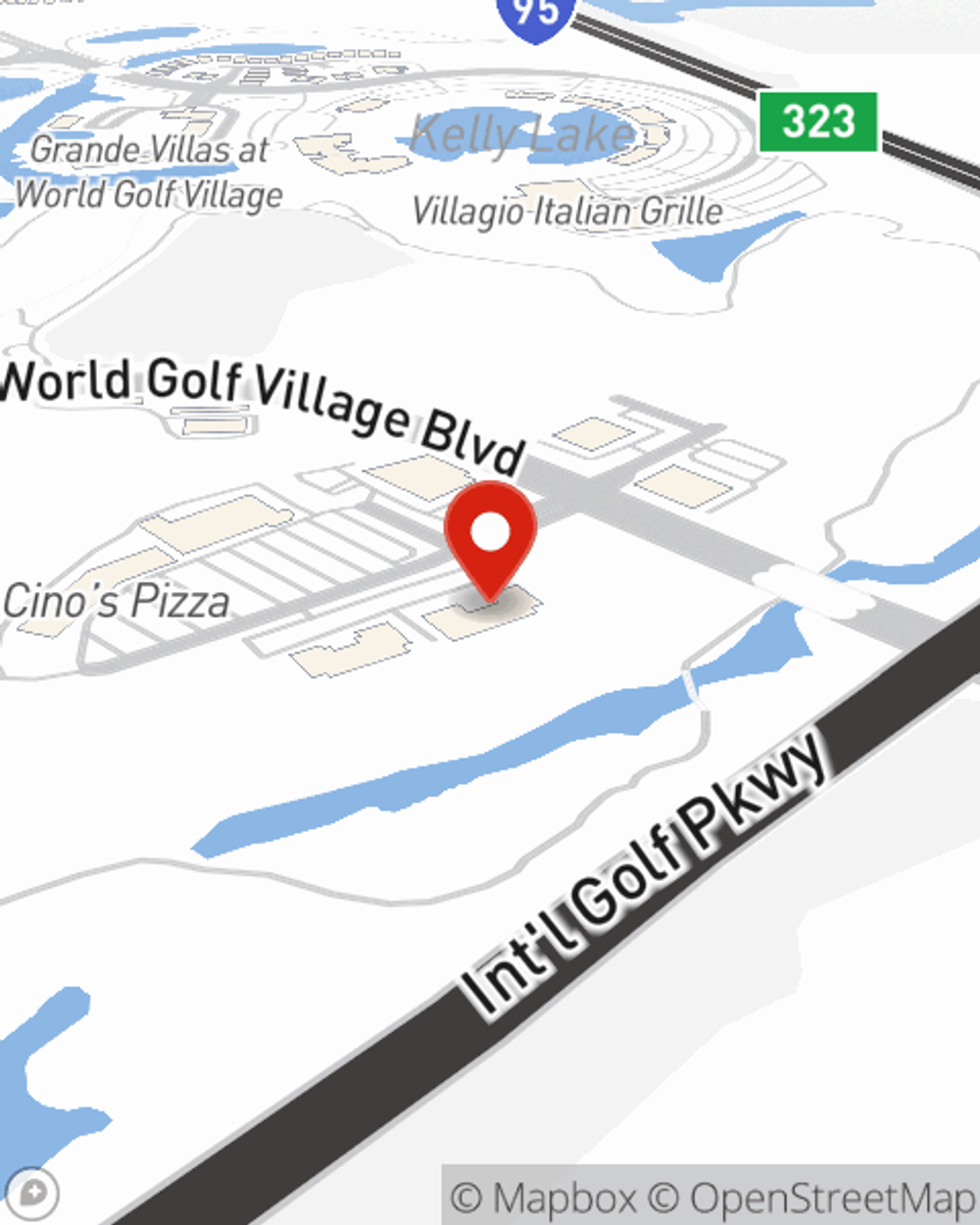

Business Insurance in and around St Augustine

Researching protection for your business? Look no further than State Farm agent Craig Dewhurst!

Cover all the bases for your small business

Help Prepare Your Business For The Unexpected.

Owning a business is a 24/7 commitment. You want to make sure your business and everyone connected to it are covered in the event of some unexpected trouble or damage. And you also want to care for any staff and customers who hurt themselves on your property.

Researching protection for your business? Look no further than State Farm agent Craig Dewhurst!

Cover all the bases for your small business

Customizable Coverage For Your Business

No one knows what tomorrow will bring—especially in the business world. Since even your brightest plans can't predict product availability or global catastrophes. In business, you can be certain of one thing: nothing is certain. That’s why it makes good sense to plan for the unexpected with a State Farm small business policy. Business insurance covers your business from all kinds of mishaps and troubles.. It protects your future with coverage like extra liability and worker's compensation for your employees. Terrific coverage like this is why St Augustine business owners choose State Farm insurance. State Farm agent Craig Dewhurst can help design a policy for the level of coverage you have in mind. If troubles find you, Craig Dewhurst can be there to help you file your claim and help your business life go right again.

Ready to research the specific options that may be right for you and your small business? Simply contact State Farm agent Craig Dewhurst today!

Simple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.

Craig Dewhurst

State Farm® Insurance AgentSimple Insights®

How to write a business plan step by step

How to write a business plan step by step

A business plan helps you get organized, tap into the ideal market, dive deep into the competition & examine your financial situation for the first couple of years.

DIY home improvement or hire a pro?

DIY home improvement or hire a pro?

Before jumping into a home improvement project, weigh the pros and cons of a DIY approach vs. hiring a professional contractor.